S&P 500 flickers near the flatline as trade tensions deepen

The S&P 500 hovers near unchanged levels amid escalating global trade tensions, keeping investors cautious and markets on edge.

- 9 Apr 2025

- Nikhil Bagoriya

- bestblog.today

The S&P 500 traded near the flatline Wednesday in another volatile sessions, as traders looked for a market bottom after days of volatility even as China and the European Union announced retaliatory tariffs on U.S. goods in the latest escalation of global trade tensions.

The broad market index inched down less than 0.1%. The Dow Jones Industrial Average fell 111 points, or 0.3%. Meanwhile, the Nasdaq Composite outperformed to rise 0.7%.

China announced it will impose an 84% levy on U.S. goods starting Thursday. This comes after U.S. tariffs of 104% on Chinese imports took effect shortly after midnight. The EU also approved its first set of tariffs on the U.S. set to start on April 15.

U.S. tariffs on imports from other countries also took effect. Canada reconfirmed Tuesday plans to put into effect 25% retaliatory tariffs on U.S.-made vehicles. This includes vehicles that aren’t compliant with the United States-Mexico-Canada Agreement, in addition to non-Canadian and non-Mexican content of USMCA-compliant fully assembled vehicles brought into Canada from the U.S.

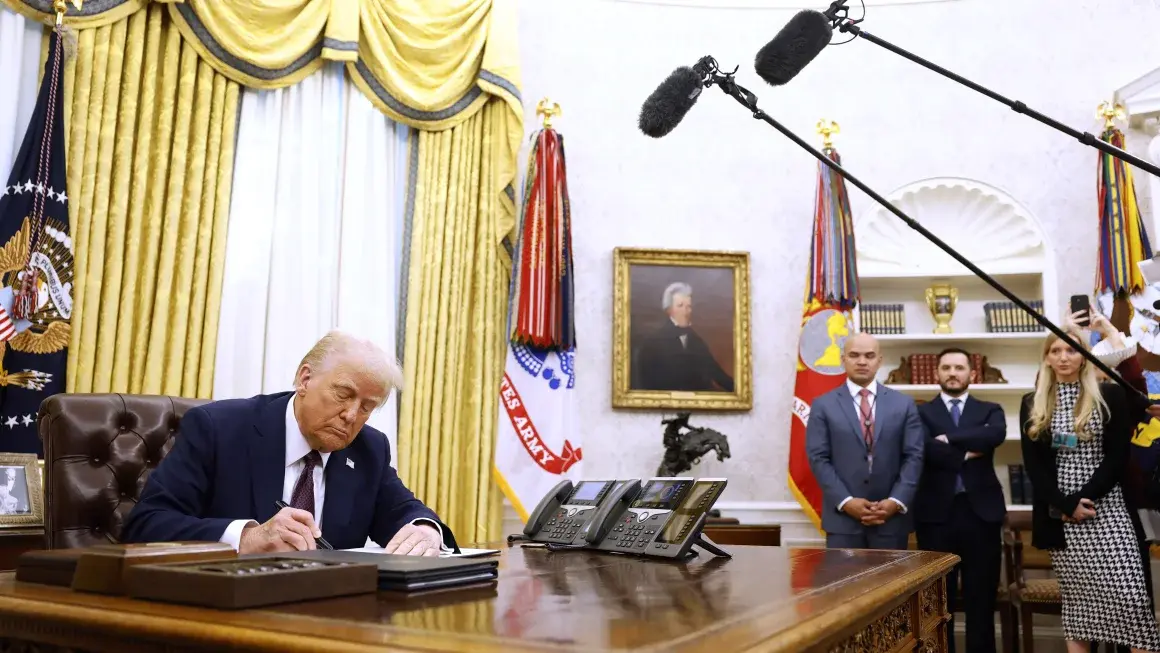

Some traders appeared briefly encouraged Wednesday morning after Treasury Secretary Scott Bessent said he would be taking a lead negotiating role in tariff talks. Wall Street would favor a bigger role for Bessent over Commerce Secretary Howard Lutnick or trade advisor Peter Navarro.

Shortly after the market open Wednesday, President Donald Trump urged investors to remain calm in a post on Truth Social. Trump also added “this is a great time to buy.”

Anxiety around the rollout of the tariffs has fueled a four-day rout for stocks. The volatility continued on Tuesday, with the S&P 500 up more than 4% at one point before ending the day with a loss of 1.6%. The 30-stock Dow climbed 3.9% at its high for the day but ultimately fell 0.8% at the end of trading. The broad market index is nearly 19% off its record high.

READ More

Releted News

-

flickers near the flatline

9 Apr 2025

Read More -

fight to the end

8 Apr 2025

Read More -

DOJ attorney placed

6 Apr 2025

Read More -

Today in Politics

5 Apr 2025

Read More -

Parliament Budget Session

2 Apr 2025

Read More -

Have Already Ended

31 Mar 2025

Read More -

Bangkok airport

28 Mar 2025

Read More -

Political black comedy

27 Mar 2025

Read More -

Trump officials

26 Mar 2025

Read More -

Gujarat Titans Is Playing

25 Mar 2025

Read More -

Kunal Kamra Eknath Shinde

24 Mar 2025

Read More -

Top House Democrats

21 Mar 2025

Read More -

Top House Democrats

21 Mar 2025

Read More -

Zelensky Halt Strikes

20 Mar 2025

Read More -

Putin humiliates Trump

19 Mar 2025

Read More -

Nagpur violence

18 Mar 2025

Read More -

BJP Leaders Held

17 Mar 2025

Read More -

Trump Administration

16 Mar 2025

Read More -

Pakistan train hijack

15 Mar 2025

Read More -

Gold smuggling case

14 Mar 2025

Read More -

Gunmen shot them all

13 Mar 2025

Read More -

Jio Starlink India

12 Mar 2025

Read More -

lead the charge

11 Mar 2025

Read More -

Carney’s Trump Challenge

10 Mar 2025

Read More -

South Carolina Executes

8 Mar 2025

Read More -

CNBC Daily Open

7 Mar 2025

Read More -

Ranya Rao Dubai Trips

6 Mar 2025

Read More -

Donald Trump speech

5 Mar 2025

Read More -

America on Trump

5 Mar 2025

Read More -

Trump pauses all U.S

4 Mar 2025

Read More -

Himani Narwal Case

3 Mar 2025

Read More -

Europe Mediates Rift

3 Mar 2025

Read More -

Three strikes

1 Mar 2025

Read More -

Judge Blocks Firings

28 Feb 2025

Read More -

Supreme Court Pauses Aid

27 Feb 2025

Read More -

US Breaks Ukraine Support

25 Feb 2025

Read More -

US Russia UNSC Stance

25 Feb 2025

Read More -

Telangana Tunnel Crisis

24 Feb 2025

Read More -

Friedrich Merz Germany

24 Feb 2025

Read More -

Zelensky Trump Relations

22 Feb 2025

Read More -

USAID Fund Controversy

22 Feb 2025

Read More -

Delhi BJP's New Initiatives

21 Feb 2025

Read More -

Bibas Family Tragedy

21 Feb 2025

Read More -

Delhi CM Oath Event

19 Feb 2025

Read More -

Musk Wins Ruling

19 Feb 2025

Read More -

Social Security Chief Resigns

18 Feb 2025

Read More -

Congress Slams CEC Appointment

18 Feb 2025

Read More -

Trump Seeks Power to Fire

17 Feb 2025

Read More -

Lalu on Kumbh Stampede

16 Feb 2025

Read More -

Maha Kumbh Tragedy

15 Feb 2025

Read More -

Justice Dept. Turmoil

15 Feb 2025

Read More -

Reciprocal Tariff Impact

14 Feb 2025

Read More -

Trump Modi Warmth

14 Feb 2025

Read More -

Modi hopes to keep India

13 Feb 2025

Read More -

Modi hopes to keep India

13 Feb 2025

Read More -

PM Modi France Visit

12 Feb 2025

Read More -

Musk Backs DOGE, Deflects Conflict

12 Feb 2025

Read More -

Plane Collision at Arizona Airport

11 Feb 2025

Read More -

Trump Adds New Tariffs

11 Feb 2025

Read More -

Impact of U.S. Tariffs on India

10 Feb 2025

Read More -

U.S Increases Tariffs

10 Feb 2025

Read More -

Trump Cuts Aid Jobs

7 Feb 2025

Read More -

Nagpur Man’s Costly Dunki

7 Feb 2025

Read More -

Jaishankar on Deportation

6 Feb 2025

Read More -

Trump Bans Trans Athletes

6 Feb 2025

Read More -

Trump on Reporter’s Accent

5 Feb 2025

Read More -

US Deports 104 Indians

5 Feb 2025

Read More -

Akash Bobba Joins DOGE

4 Feb 2025

Read More -

China Hits Back with Tariffs

4 Feb 2025

Read More -

Trump's Tariffs Shake Markets

3 Feb 2025

Read More -

Kejriwal Targets Rajiv Kumar

3 Feb 2025

Read More -

Philly Medical Jet Crash

1 Feb 2025

Read More -

Budget 2025 Opposition Walkout

1 Feb 2025

Read More -

Modi Jabs Opposition

31 jan 2025

Read More -

Trump on Aviation Safety

31 jan 2025

Read More -

Trump Demands BRICS Loyalty

31 jan 2025

Read More -

Patel Enemies List Fallout

30 jan 2025

Read More -

Fatal Aircraft Collision Updates

30 jan 2025

Read More -

Trump Bans Trans Troops

28 jan 2025

Read More