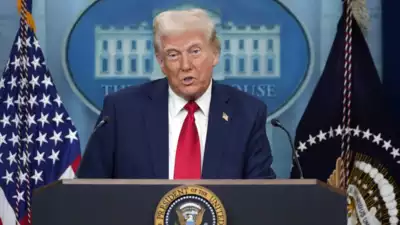

Trump announces fresh round of tariffs on steel and aluminum

The 25 percent tariffs on imported steel and aluminum are the latest salvo in his ongoing effort to overhaul the U.S. trading relationship with the rest of the world.

- 11 Feb 2025

- Shivani Verma

- bestblog.today

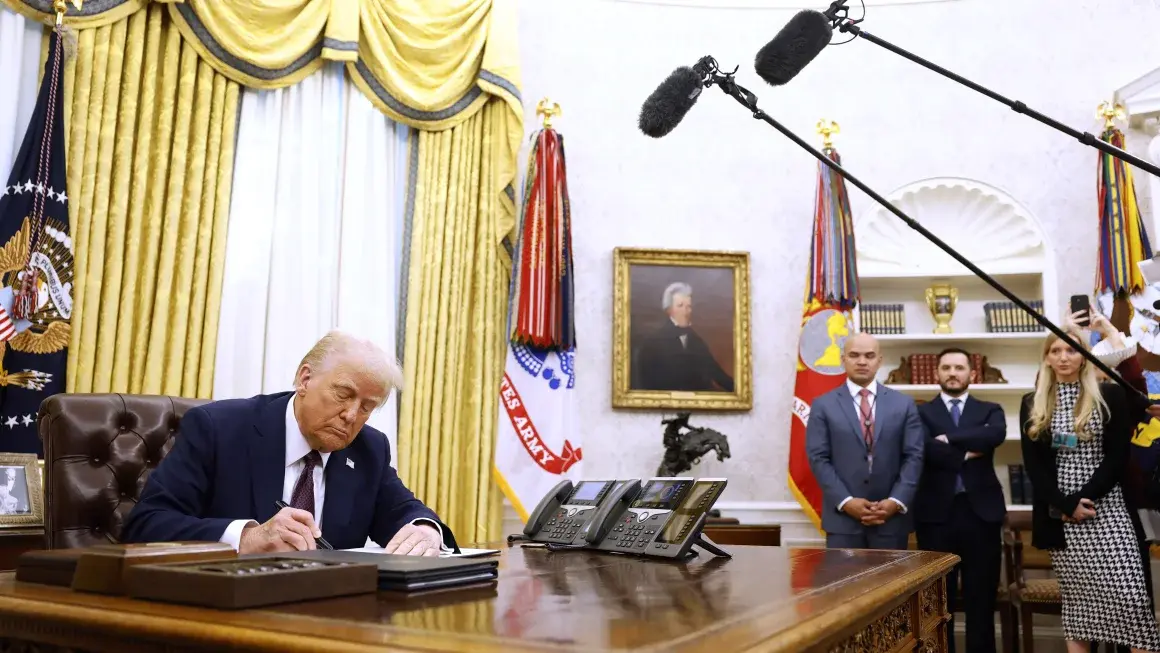

President Donald Trump signed a pair of executive orders on Monday imposing 25 percent tariffs on imported steel and aluminum, the latest salvo in his ongoing effort to overhaul the U.S. trading relationship with the rest of the world.

This is a big deal — making America rich again, Trump said as he signed the orders.

The president’s actions are designed to promote greater domestic steel industry production and employment. But they will increase costs for manufacturers that use the industrial metals to produce goods such as automobiles and appliances. Those higher costs are at odds with Trump’s repeated campaign promises to bring down the cost of living.

This isn’t just about trade. It’s about ensuring that America never has to rely on foreign nations for critical industries like steel and aluminum, said Peter Navarro, White House senior counselor for trade and manufacturing.

Even before the official announcement, which the president previewed Sunday, the European Commission slammed it as “unlawful and counterproductive. German Chancellor Olaf Scholz vowed that Germany, Europe’s largest exporter of steel to the United States, could retaliate “within an hour” of any U.S. move.

Trump may announce additional U.S. trade measures as soon as Tuesday. He has promised to debut a new reciprocal tariff that would set U.S. import taxes to match those that other nations apply to U.S. products. One target is the European Union, which maintains a 10 percent tariff on cars imported from the United States while European vehicles are hit with a 2.5 percent U.S. tax when sold to American customers.

Trump’s reciprocal plan would represent a departure from recent decades when U.S. policymakers sought lower tariffs in most cases to reduce product costs and spur global integration. Trump’s new approach would further increase U.S. trade barriers, particularly on products from nations such as India and Brazil.

Combined with the raft of tariff plans he has proposed or implemented since taking office three weeks ago, the reciprocal proposal underscores Trump’s determination to enact historic changes in U.S. trade policy.

The steel and aluminum tariffs, meanwhile, are likely to renew tensions between the United States and its North American neighbors, which are among its largest suppliers of steel imports. The president just last week paused plans to impose a separate set of import taxes on goods from Canada and Mexico, which he linked to concerns over immigration and drug trafficking.

Canada, the No. 1 foreign supplier to the United States, last year shipped 6.6 million tons of steel to American buyers, according to the American Iron and Steel Institute (AISI). Brazil, Mexico, South Korea and Vietnam rounded out the top five import sources.

Though China is a relatively modest U.S. supplier, shipping 508,000 tons to U.S. customers, its global dominance of the steel industry makes it the administration’s real target.

China produces more than half of global steel output. As its domestic economy has slowed amid the collapse of a property bubble, its mills have continued to churn out more steel than the country’s builders and manufacturers can use.

The amount of excess steel available on global markets in 2023 reached 551 million metric tons, four times what the European Union produced, according to the Organization for Economic Cooperation and Development in Paris. That surplus supply weighs on global prices, keeping them too low for U.S. steelmakers to operate profitably without tariff protection.

In 2018, Trump imposed similar import taxes on steel and aluminum during his first term. They were later amended to permit continuing shipments from major U.S. allies such as Canada and Mexico, and replaced with an annual quota for Argentina, Brazil and several other nations.

But provisions for specific products in some cases, or all metals from countries like South Korea, to avoid those tariffs have been abused, a White House official said. The result has been continued weakness in the domestic industry, including the closure in recent years of aluminum smelters in Kentucky and Washington state.

Steel industry executives also complain that Chinese steel often enters the U.S. market via third countries such as Mexico.

Both China and Russia have exploited loopholes in the existing metals tariffs to ship their steel and aluminum to the United States via Canada and Mexico, the official told reporters Monday.

The new tariff regime aims to close those loopholes by instituting requirements for steel and aluminum to be cast or smelt in North America before reaching the U.S. market. Customs and Border Protection officials also will intensity their oversight of industrial metals shipments to prevent Chinese or Russian products being mislabeled to evade tariffs, the official said.

REED MORE

Releted News

-

flickers near the flatline

9 Apr 2025

Read More -

fight to the end

8 Apr 2025

Read More -

DOJ attorney placed

6 Apr 2025

Read More -

Today in Politics

5 Apr 2025

Read More -

Parliament Budget Session

2 Apr 2025

Read More -

Have Already Ended

31 Mar 2025

Read More -

Bangkok airport

28 Mar 2025

Read More -

Political black comedy

27 Mar 2025

Read More -

Trump officials

26 Mar 2025

Read More -

Gujarat Titans Is Playing

25 Mar 2025

Read More -

Kunal Kamra Eknath Shinde

24 Mar 2025

Read More -

Top House Democrats

21 Mar 2025

Read More -

Zelensky Halt Strikes

20 Mar 2025

Read More -

Putin humiliates Trump

19 Mar 2025

Read More -

Nagpur violence

18 Mar 2025

Read More -

BJP Leaders Held

17 Mar 2025

Read More -

Trump Administration

16 Mar 2025

Read More -

Pakistan train hijack

15 Mar 2025

Read More -

Gold smuggling case

14 Mar 2025

Read More -

Gunmen shot them all

13 Mar 2025

Read More -

Jio Starlink India

12 Mar 2025

Read More -

lead the charge

11 Mar 2025

Read More -

Carney’s Trump Challenge

10 Mar 2025

Read More -

South Carolina Executes

8 Mar 2025

Read More -

CNBC Daily Open

7 Mar 2025

Read More -

Ranya Rao Dubai Trips

6 Mar 2025

Read More -

Donald Trump speech

5 Mar 2025

Read More -

America on Trump

5 Mar 2025

Read More -

Trump pauses all U.S

4 Mar 2025

Read More -

Himani Narwal Case

3 Mar 2025

Read More -

Europe Mediates Rift

3 Mar 2025

Read More -

Three strikes

1 Mar 2025

Read More -

Judge Blocks Firings

28 Feb 2025

Read More -

Supreme Court Pauses Aid

27 Feb 2025

Read More -

US Breaks Ukraine Support

25 Feb 2025

Read More -

US Russia UNSC Stance

25 Feb 2025

Read More -

Telangana Tunnel Crisis

24 Feb 2025

Read More -

Friedrich Merz Germany

24 Feb 2025

Read More -

Zelensky Trump Relations

22 Feb 2025

Read More -

USAID Fund Controversy

22 Feb 2025

Read More -

Delhi BJP's New Initiatives

21 Feb 2025

Read More -

Bibas Family Tragedy

21 Feb 2025

Read More -

Delhi CM Oath Event

19 Feb 2025

Read More -

Musk Wins Ruling

19 Feb 2025

Read More -

Social Security Chief Resigns

18 Feb 2025

Read More -

Congress Slams CEC Appointment

18 Feb 2025

Read More -

Trump Seeks Power to Fire

17 Feb 2025

Read More -

Lalu on Kumbh Stampede

16 Feb 2025

Read More -

Maha Kumbh Tragedy

15 Feb 2025

Read More -

Justice Dept. Turmoil

15 Feb 2025

Read More -

Reciprocal Tariff Impact

14 Feb 2025

Read More -

Trump Modi Warmth

14 Feb 2025

Read More -

Modi hopes to keep India

13 Feb 2025

Read More -

Modi hopes to keep India

13 Feb 2025

Read More -

PM Modi France Visit

12 Feb 2025

Read More -

Musk Backs DOGE, Deflects Conflict

12 Feb 2025

Read More -

Plane Collision at Arizona Airport

11 Feb 2025

Read More -

Trump Adds New Tariffs

11 Feb 2025

Read More -

Plane Collision at Arizona Airport

11 Feb 2025

Read More -

Trump Adds New Tariffs

11 Feb 2025

Read More -

Impact of U.S. Tariffs on India

10 Feb 2025

Read More -

U.S Increases Tariffs

10 Feb 2025

Read More -

Trump Cuts Aid Jobs

7 Feb 2025

Read More -

Nagpur Man’s Costly Dunki

7 Feb 2025

Read More -

Jaishankar on Deportation

6 Feb 2025

Read More -

Trump Bans Trans Athletes

6 Feb 2025

Read More -

Trump on Reporter’s Accent

5 Feb 2025

Read More -

US Deports 104 Indians

5 Feb 2025

Read More -

Akash Bobba Joins DOGE

4 Feb 2025

Read More -

China Hits Back with Tariffs

4 Feb 2025

Read More -

Trump's Tariffs Shake Markets

3 Feb 2025

Read More -

Kejriwal Targets Rajiv Kumar

3 Feb 2025

Read More -

Philly Medical Jet Crash

1 Feb 2025

Read More -

Budget 2025 Opposition Walkout

1 Feb 2025

Read More -

Modi Jabs Opposition

31 jan 2025

Read More -

Trump on Aviation Safety

31 jan 2025

Read More -

Trump Demands BRICS Loyalty

31 jan 2025

Read More -

Patel Enemies List Fallout

30 jan 2025

Read More -

Fatal Aircraft Collision Updates

30 jan 2025

Read More -

Trump Bans Trans Troops

28 jan 2025

Read More